No One Cares Who Manages Their Money

The article analyzes the emergence of Faster Payment Systems as a global trend changing the payment landscape and habits and predicts their perspective.

"No-One Cares Which Bank Provides Their Apple Card."

This is the news headline I read recently on Forbes. It relates to the change of the bank that issues bank cards for Apple. While the news might impact the banking and fintech community, it was not newsworthy for the general public and the final consumers. It made me think.

As brutal as it sounds, it is honest as well. What banks feared about Big Techs and FinTechs taking their role away has already happened. You and I will only know, love, and trust the app icon we identify as our banking app. What truly lies beneath, we do not care. Our beloved banking app might just be a nice design and a marketing budget, while all the heavy lifting (storing money, managing money, fighting fraud, etc.) is done by some other company(ies).

Do you care who moves your money quickly and easily 24/7 via phone number or QR-code? It is so convenient without a bank card or bank account details.

Well, for better or worse, soon enough, managing your money will no longer be the job of banks.

How will that happen? Fast Payment Systems.

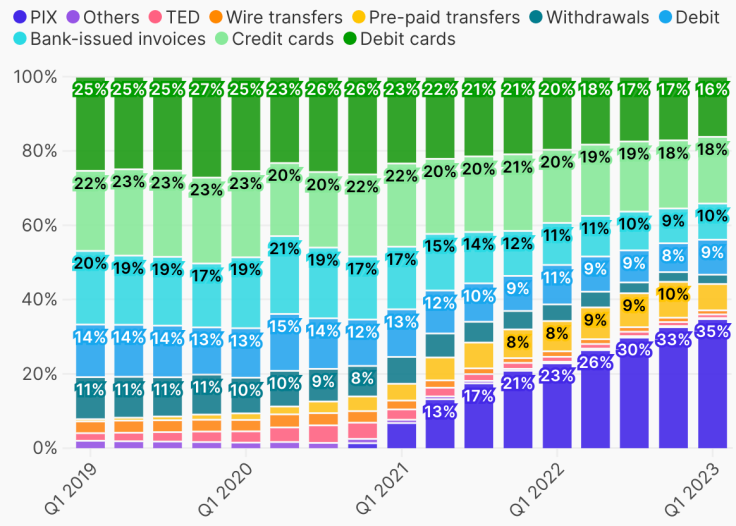

Fast Payment Systems are rolled out as consumer-oriented payment systems and innovative technological products in most countries. PromptPay in Thailand, UPI in India, Pix in Brazil, SBP in Russia, Zengin in Japan, Bizum in Spain, QRIS in Indonesia, Swish in Sweden, DuitNow in Malaysia, etc. The list goes on and on, up to 40+ countries.

They have names, full-fledged brands, nice logos featured on POS terminals and checkout pages, and some store marketing and advertising budgets. They look and feel like commercial retail payment systems. Like PayPal, Venmo, Alipay, GrabPay, Momo — or whatever payment system your country has.

What is wrong with that?

Nothing. Except those are not run by commercial entities, not by public or private businesses. They are run either by central banks (read governments) or bank unions. They are banking clearing systems at their core.

Do you know the names of the banking clearing systems in your country? Each country has at least 3 of them — for the slow batch-based settlement, for faster, almost real-time settlement, and for the true real-time settlement we now know as Fast Payment Systems. Why do we only know the last type? Because they are now customer-oriented and not by accident.

Fast Payment Systems compete with Visa and MasterCard, e-wallet brands for your brand awareness and choice. Fast Payment Systems compete with the banks themselves. Fast Payment Systems are a huge pain for them, challenging their business models, liquidity, and profitability. So, in many countries, they are forced upon the banks by the central banks for adoption and distribution to you and your eyes.

Your choice of how to send money for coffee to your friend no longer depends on which banks you and your friend have. You either open your banking app (any bank, really) and choose the fast payment system to send the money. Or you scan a QR code and do not even bother to open a banking app.

FPS' significance and future perspectives

Fast Payment Systems are a global event, a shift from the commercially run payments industry to the government-run payments industry. Combine the Fast Payment Systems for money movement with the CBDCs for centralized money storage, and you might find yourself in a pretty different world than today's. It might not be as grim as it sounds; regulatory power and commercial interest combined in one entity does not necessarily mean trouble. Right?

Anna Kuzmina is an entrepreneur, serial C-level executive, author, and eager member of the global fintech community. Before setting up the independent consulting business, Anna grew her expertise in fintech for over a decade and contributed to media and her blog.

To add to this, Anna is the former COO at a Hong Kong fintech company, deputy chairman of a CIS digital bank, deputy chief of commerce at YooMoney (ex Yandex.Money), and head of payments at Xsolla. Furthermore, she is also frequent speaker at international fintech conferences and a core contributor to the WTM blog.

© Copyright IBTimes 2024. All rights reserved.